A few weeks ago I reviewed Ben Goldacre’s new book, Bad Pharma, an examination of the pharmaceutical industry, and more broadly, of the way new drugs are discovered, developed and brought to market. As I have noted before, despite the very different health systems that exist around the world, we all rely on private, for-profit, pharmaceutical companies to supply drug products and also to bring newer, better therapies to market. It’s great when there are lots of new drugs appearing, and they’re affordable for consumers and health systems. But that doesn’t seem to be the case. Pipelines seem to be drying up, and the cost of new drugs is climbing. Manufacturers refer to the costs of drug development when explaining high drug prices: New drugs are expensive, we’re told, because developing drugs is a risky, costly, time consuming endeavor. The high prices for new treatments are the price of innovative new treatments, both now and in the future. Research and development (R&D) costs are used to argue against strategies that could reduce company profitability (and presumably, future R&D), be it hospitals refusing to pay high drug costs, or changing patent laws that will determine when a generic drug will be marketed.

The overall costs of R&D are not the focus in Goldacre’s book, receiving only a short mention in the afterword, where he refers to the estimate of £500 million to bring a drug to market as “mythical and overstated.” He’s not alone in his skepticism. There’s a fair number of papers and analyses that have attempted to come up with a “true” estimate, and some authors argue the industry does not describe the true costs accurately or transparently enough to allow for objective evaluations. Some develop models independently, based on publicly available data. All models, however, must incorporate a range of assumptions that can influence the output. Over a year ago I reviewed at a study by Light and Warburton, entitled Demythologizing the high costs of pharmaceutical research, which estimated R&D costs at a tiny $43.4 million per drug – not £500 million, or the $1 billion you may see quoted. Their estimates, however, were based on a sequence of highly implausible assumptions, meaning the “average” drug development costs are almost certainly higher in the real world. But how much higher isn’t clear. There have been at least eleven different studies published that estimate costs. Methods used range from direct data collection to aggregate industry estimates. Given the higher costs of new drugs, having an understanding of the drivers of development costs can help us understand just how efficiently this industry is performing. There are good reasons to be critical of the pharmaceutical industry. Are R&D costs one of them?

Is the low-hanging fruit gone?

A growing concern with the pharmaceutical industry is its overall productivity in delivering new drugs. There’s a relationship assumed between what what’s spent (R&D) and the number of new drugs that get approved. Ignoring the fact that quantity is a poor guide to quality, let’s look at the crude values: It does appear that the number of new drugs approved is dropping. Here’s a European snapshot [PDF]:

And FDA approvals show the same downward trend:

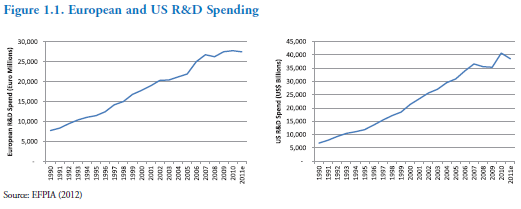

At the same time, the amount spent on R&D, both in Europe and the US, has steadily climbed during most of this period:

Here’s another view with a even longer timeframe, from a paper on R&D efficiency published in March 2012 in Nature Reviews Drug Discovery:

The number of new drugs approved FDA per billion US dollars has halved about every 9 years. Remember Moore’s law, suggesting the number of transistors on integrated circuts doubles every 18 months? The authors of this paper introduce Eroom’s law – Moore spelled backwards:

Eroom’s Law indicates that powerful forces have outweighed scientific, technical and managerial improvements over the past 60 years, and/or that some of the improvements have been less ‘improving’ than commonly thought. The more positive anyone is about the past several decades of progress, the more negative they should be about the strength of countervailing forces. If someone is optimistic about the prospects for R&D today, they presumably believe the countervailing forces — whatever they are — are starting to abate, or that there has been a sudden and unprecedented acceleration in scientific, technological or managerial progress that will soon become visible in new drug approvals.

Spending is up, productivity down. The data suggest the decline is real, which may mean claims drugs are becoming more expensive to develop are real. Matthew Herper did some rough calculations earlier this year in Forbes using publicly available data. He pulled R&D spending for companies over 15 years, and divided that by the number of new drugs developed per company during that time. He estimated the costs per drug per company ranged from $4 billion to $11 billion. A crude estimate, yes, and one that doesn’t account for the time lag in developments. But as a rough yardstick, it suggests that the costs per approved drug are more likely to be measured in billions and not millions.

Let the finger pointing begin. Here’s where you’ll see the blame split – some say it’s a regulatory issue and a consequence of of FDA stringency, while others point to industry as engineering its own misfortune. Setting aside blame (for now), let’s look at the drivers and the productivity issue. There’s also a new R&D estimate out from the Office of Health Economics, a UK-based consultancy and research group. The paper, entitled The R&D Cost of a New Medicine, is the latest academic attempt to quantify the “average” cost of developing a new drug.. I’ll first note that this analysis was “partially funded by an unrestricted research grant” from AstraZeneca. Keeping that potential bias in mind, let’s start with their bottom line:

Published estimates of the mean (average) cost of researching and developing a successful new medicine suggest an increased over the last decade—from the estimate of US$802m by DiMasi et al (2003) at 2000 prices (US$1,031m at 2011 prices) to the estimate by Paul et al (2010) of US$1,867m at 2011 prices. In this study, we present a new estimate, US$1,506m (at 2011 prices), which lies within this range. Our analysis explores how these costs have been evolving and for what reasons.

First, a review. Drug development isn’t a sequential process. It only looks that way in hindsight when you have a successful drug. R&D may be better thought of as maze, with countless dead ends. And in some cases, no solution at all. Given we can’t accurately forecast the future, drug development becomes a series of decisions under uncertainty: Looking at the evidence collected to date, estimating probabilities, and factoring in costs. Every potential new drug passes through countless “go/no go” decisions – first identifying molecules and biological pathways of interest, then developing potential compounds, and possibly testing them in increasingly rigorous studies that start in test tubes, proceed to animals, and ultimately may end up in human trials. This diagram shows the steps:

This complicated diagram illustrates the attrition risk, and the approximate time involved at each step. Importantly, what’s called “basic research” and then “discovery research” component is the “research” part of the R&D. What follows, through trials is actually considered the “development” component. The authors argue that there are four key variables that influence overall R&D cost estimates:

1. Out-of-Pocket Costs

These are the direct costs spent on trials, recognizing that not all trials make it all the way through all three phases. The most recent estimates suggest that mean costs now likely exceed $200 million for all three phases, and these costs have been increasing over time, up 600% since the 1970’s. The factors that can influence OOP costs include:

- The cost of each patient (recruitment, treatment, etc.)

- The number of patients in the trial.

- The complexity of the trial, including its duration. Complexity could be driven by regulatory demands for better evidence, or simply treatment of more challenging conditions. For example, studying a treatment for urinary track infections, is quite a bit simpler than studying a drug that treats Alzheimer’s disease.

- Where the trial is done. Outsourcing the trial to Asia is much cheaper than conducting studies in North America. As other costs rise, companies have been shifting

2. Success Rates

The first goal is finding a possible drug. This is an area where there’s a vast difference of opinion between those that work on drug development, and those that criticize it. (If you’re interested in the development perspective, Derek Lowe’s blog can’t be beat.) Assuming we’ve identified a potential drug (which can take years and years), we’ll move into clinical trials. Throughout the development process, cold calculations are applied to the results: Should development continue? The chance of proceeding past each phase was estimated based on literature that looked at different samples of drugs:

Passing Phase I: 49% to 75% of drug candidates move forward

Passing Phase II: 30% to 48% of remaining drug candidates move forward

Passing Phase III: 50% to 71% of remaining drug candidates will go on to

The authors refer to different estimates and conclude that rates have increased over time. Whether this is due to more stringent standards established by risk averse regulators, or because finding effective drugs is getting harder is difficult to say. Failure rates could also reflect more effective scrutiny by industry, killing off weaker drug candidates, earlier. As the costs of new drugs continues to be scrutinized, research termination could also include economic reasons. When we consider this trend in the context of missing or unpublished data, it would suggest that these may be overestimates of what the true success rates should be. Based on this analysis, the authors estimate it takes between 4 and 14 drugs to enter phase I trial for a single drug to make it through to final registration.

3. Development Times

Based on estimates taken from other papers on development, the authors noted the time from phase I to phase III has been fairly consistent – about 6.5 years. So if trials are getting more complicated, and the regulatory review is more intense, this hasn’t shown up in the past. This is a positive sign, as longer development times delay potentially useful drugs but also eat into overall profits, given a fixed patent expiry date.

4. The Cost of Capital

The cost of capital enrages pharmaceutical industry critics, who don’t seem to understand that it’s a real cost. The cost of capital is the rate of return a company is expected to generate for its owners. That is, if investors are making bets (and that’s essentially what this is) on the future payoff of a potential drugs, they need to factor in the revenue they could generate by investing elsewhere in a project of similar risk. It’s true that the cost of capital doesn’t reflect a cash outlay. It’s also true that R&D costs receive preferential tax treatment. However this only changes who ultimately covers the cost. Taking risks like the pharmaceutical industry does means massive bets, with payoffs that might stretch decades in the future, or might disappear suddenly if a safety or efficacy problem is identified in the future. These authors use a cost of capital of 11%, which sounds excessive considering what your bank account may be paying in interest, but may represent a fair estimate for pharma given investing in drug development looks riskier and riskier.

The Critics

As I’ve pointed out before, there are considerable criticisms of R&D estimates that have appeared in the literature. One outspoken critic is Marcia Angell, former editor of the New England Journal of Medicine who has argued that R&D costs are only a fraction of published estimates. Specific criticisms include the confidential nature of the data analyzed – the transparency issue again. Selection bias is also cited, suggesting that companies that have shared data may have only included more expensive drugs, and not drugs that represent slight variations of existing drugs (“me-toos”) which presumably are significantly less expensive to develop. She has also criticized using the cost of capital in these estimates. Other critics, like Merrill Goozner have argued that much of the development costs are borne by the public sector (i.e., NIH). He also points to the competitive nature of drug development which creates waste through duplicative effort at different companies. Other criticisms in the literature include the complexity of estimating the costs of drugs that are discovered by small companies, and then licensed to larger companies to complete the registration process. There are fair points in many of these criticisms. However, none do an adequate job of explaining the current state: fewer drugs approved, and higher costs incurred.

The New Estimate

For this new analysis the authors gathered data on costs from 97 development products provided by confidential surveys of pharmaceutical companies. They aggregated costs and then averaged costs for each component of research and development, estimating the overall probability of success of any single drug at 7%. The authors noted the average overall development timelines were 11.5 years. On balance, the estimated out-of-pocket costs were estimated at $899 million (2011 values). Factoring in time and cost of capital, this becomes an estimate of $1.5 billion. It’s a number within the range of other published estimates, and again, it suffers from a lack of transparency in some of the estimates it uses. Set against the industry-wide trends I noted above, this number fits into that range.

Conclusion

Criticism of the pharmaceutical industry is justified when it’s done for the right reasons. Being skeptical of R&D estimates is wise. Data on individual drugs is not transparent, and estimates must incorporate a number of assumptions which have the potential to bias the conclusions. This lack of transparency fuel suspicion of the process. But we should also be equally skeptical of arguments that dismiss or diminish the growing problems with R&D. There is good evidence to suggest that drug development is a risky, expensive endeavor, and that this work is getting harder. There’s also good evidence to suggest that the productivity of this process is declining. As consumers, this may mean fewer new drugs, and higher per-drug costs. Finally, average drugs costs are just that – averages. They’re good for talking points, but don’t diagnose the problem. Is it possible to fix the productivity decline in the pharmaceutical industry? I’ll save that discussion for a future post.